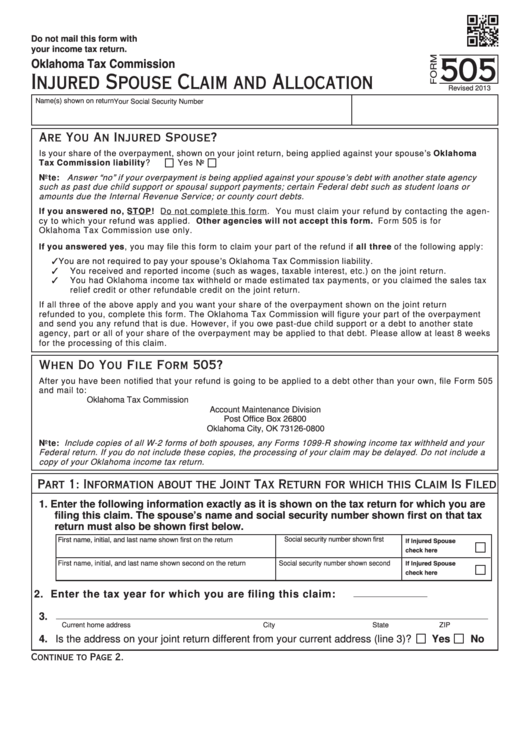

However, if your spouse has not made you aware of the fact that they have debts that might cause your refund to be kept, you can still file for injured spouse relief after the return is filed.

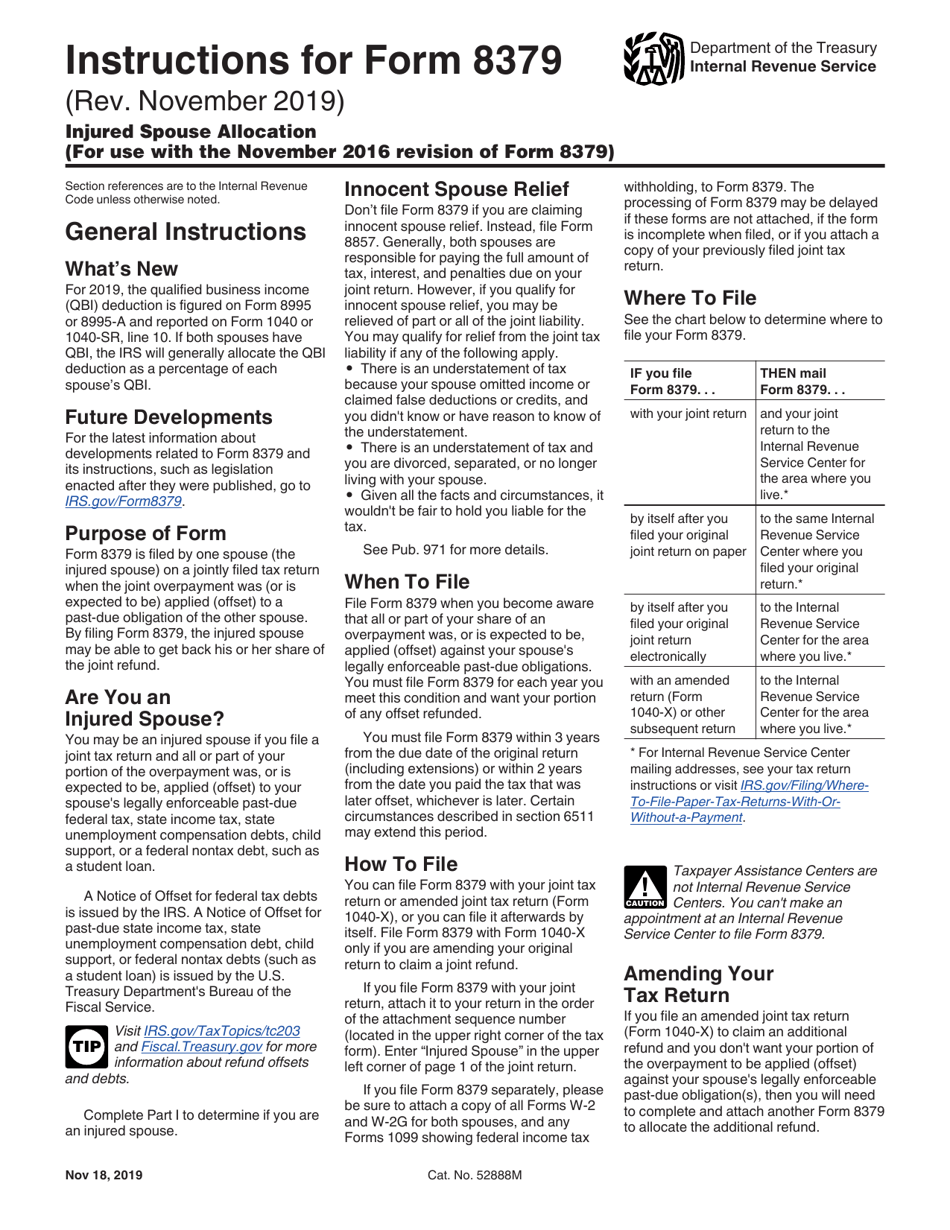

Innocent Spouse relief is used solely for the purpose of relieving yourself from an IRS tax debt you are jointly liable for.According to IRC § 6402, injured spouse relief is used when your portion of a tax refund from a jointly filed tax return is being offset and applied to a debt your spouse incurred prior to you being married and that you are not liable to pay.In order to receive relief you must generally prove that you had no knowledge of, or reason to know of, the under-reporting of income, overstatement of deductions or erroneously claimed tax credits by your spouse on a married filing joint return.

#Injured spouse form file time code

According to Internal Revenue Code (“IRC”) § 6015, innocent spouse relief is used to separate joint and several liability.Injured spouse will generally be used by someone still married to their spouse.More often than not innocent spouse relief will typically be used by someone who is legally separated or divorced from their spouse.Currently Married or Divorced/Legally Separate.Below are five differences between innocent spouse relief and injured spouse relief. Knowing the difference between the two will save you the time and headache of having to resubmit your claim because you did it wrong the first time. Often times innocent spouse and injured spouse are used interchangeably, though they are two completely different types of relief.

0 kommentar(er)

0 kommentar(er)